Are you doing foreign trade? Today, I want to introduce some common sense knowledge to you. Payment is a part of foreign trade. It is necessary for us to understand the payment habits of the target market people and choose what they like!

1、 Europe

Europeans are most accustomed to electronic payment methods except Visa and MasterCard. In addition to international cards, I also like to use some local cards, such as Maestro (English Country), Solo (United Kingdom), Laser (Ireland), Carte Bleue (France), Dankort (Denmark), Discover (United States), 4B (Spain), CartaSi (Italy), etc. Europeans are not very keen on paypal, in contrast, they are more familiar with electronic account MoneyBookers.

Countries and regions with more contacts between European and Chinese merchants include the United Kingdom and France, Germany, Spain. The online shopping market in the UK is relatively developed and very similar. In the United States, PayPal is more common in the United Kingdom. Consumers in European countries generally

To say that it is more honest, if compared, online retail in Spain is riskier already. When we conduct cross-border transactions, there will definitely be many payment methods for we choose. For example, paypal, etc., although paypal is currently the vast majority. The first choice for payment methods in foreign trade online stores, but sometimes there are still many foreign customers out of habit. Due to habit, or other factors, other payment methods will be selected. These contents open a foreign trade online store, the more you know, the greater the chance of success.

2、 North America

North America is the most developed online shopping market in the world, and consumers have long been accustomed to various payment methods such as online payment, telephone payment, electronic payment, and mail payment. In the United States, credit cards are a common payment method used online. General third-party payment service companies in the United States can process Visa and MasterCard credit cards that support 158 currencies, and support payments in 79 currencies. Chinese merchants doing business with the United States must be familiar with these electronic payment methods, and must be accustomed to and be good at using various electronic payment tools. In addition, the United States is the region with the least credit card risk. For orders from the United States, there are not many cases of disputes arising from quality reasons.

3、 Domestic

In China, the most mainstream payment platform is a non-independent third-party payment led by Alipay. These payments are made in the mode of recharge, and they all integrate the online banking functions of most banks. Therefore, in China, whether it is a credit card or a debit card, as long as your bank card has the online banking function, it can be used for online shopping. In China, the use of credit cards is not very popular, so most people still use debit cards to pay.

The development of credit cards in China is very fast, and it is estimated that credit cards will become popular in the near future. Among young white-collar workers, the use of credit cards has become a very common phenomenon. This development trend also indicates that the direct payment by credit card on the website will also gradually develop. In China’s Hong Kong, Taiwan and Macau, the most accustomed electronic payment methods are Visa and MasterCard, and they are also used to paying with PayPal electronic accounts.

4、 Japan

The local online payment methods in Japan are mainly credit card payment and mobile payment. The Japanese own credit card organization is JCB. JCB cards that support 20 currencies are often used for online payment. In addition, most Japanese people will have a Visa and a MasterCard. Compared with other developed countries, the online retail trade between Japan and China is not so developed, but offline Japanese consumption in China is still very active, especially for Japanese tourists, who can use shopping websites to establish long-term connections with them. At present, Alipay and Japan’s Softbank Payment Service Corp (hereinafter referred to as SBPS) have signed a strategic cooperation agreement to provide Alipay’s cross-border online payment services to Japanese companies. It is estimated that as Alipay enters the Japanese market, domestic users who are accustomed to Alipay can also use Alipay to directly receive Japanese yen in the near future.

5、 Australia, Singapore, South Africa

For merchants doing business with regions such as Australia, Singapore and South Africa, the most accustomed electronic payment methods are Visa and MasterCard, and they are also used to paying with PayPal electronic accounts. Online payment habits in Australia and South Africa are similar to those in the United States, with credit card payments being the norm, and PayPal being common. In Singapore, the internet banking services of the banking giants OCBC, UOB and DBS are developing rapidly, and online payment by credit and debit cards is very convenient. There are also many online shopping markets in Brazil. Although they are more cautious in online shopping, it is also a very promising market.

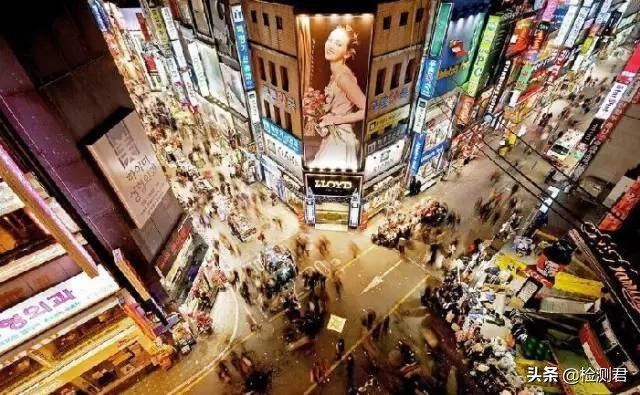

6、 Korea

The online shopping market in South Korea is very developed, and their mainstream shopping platform. Mostly C2C platforms. South Korea’s payment methods are relatively closed, and generally only provide Korean. Domestic bank cards for online payment, Visa and MasterCard) is rarely used, and visa and MasterCard are mostly listed for overseas payments. In this way, it is convenient for non-Korean foreign guests to shop. PayPal is also available in South Korea. Many people use it, but it is not a mainstream payment method.

7、Other regions

There are other regions: such as underdeveloped countries in Southeast Asia, South Asian countries. In north-central Africa, etc., these regions generally use credit cards to pay online. There are greater risks in cross-border payments in these regions. At this time, it is necessary to charge. Use anti-fraud services provided by third-party payment service providers (risk assessment system), block malicious and fraudulent orders and risky orders in advance, but once you receive orders from these regions, please think twice and do more backstopping.

Post time: Aug-20-2022