Authors:K Ganesh,Ramanath KB,Jason D Li,Li Yuanpeng,Tanmay Mothe,Hanish Yadav,Alpesh Chaddha和Neelesh Mundra

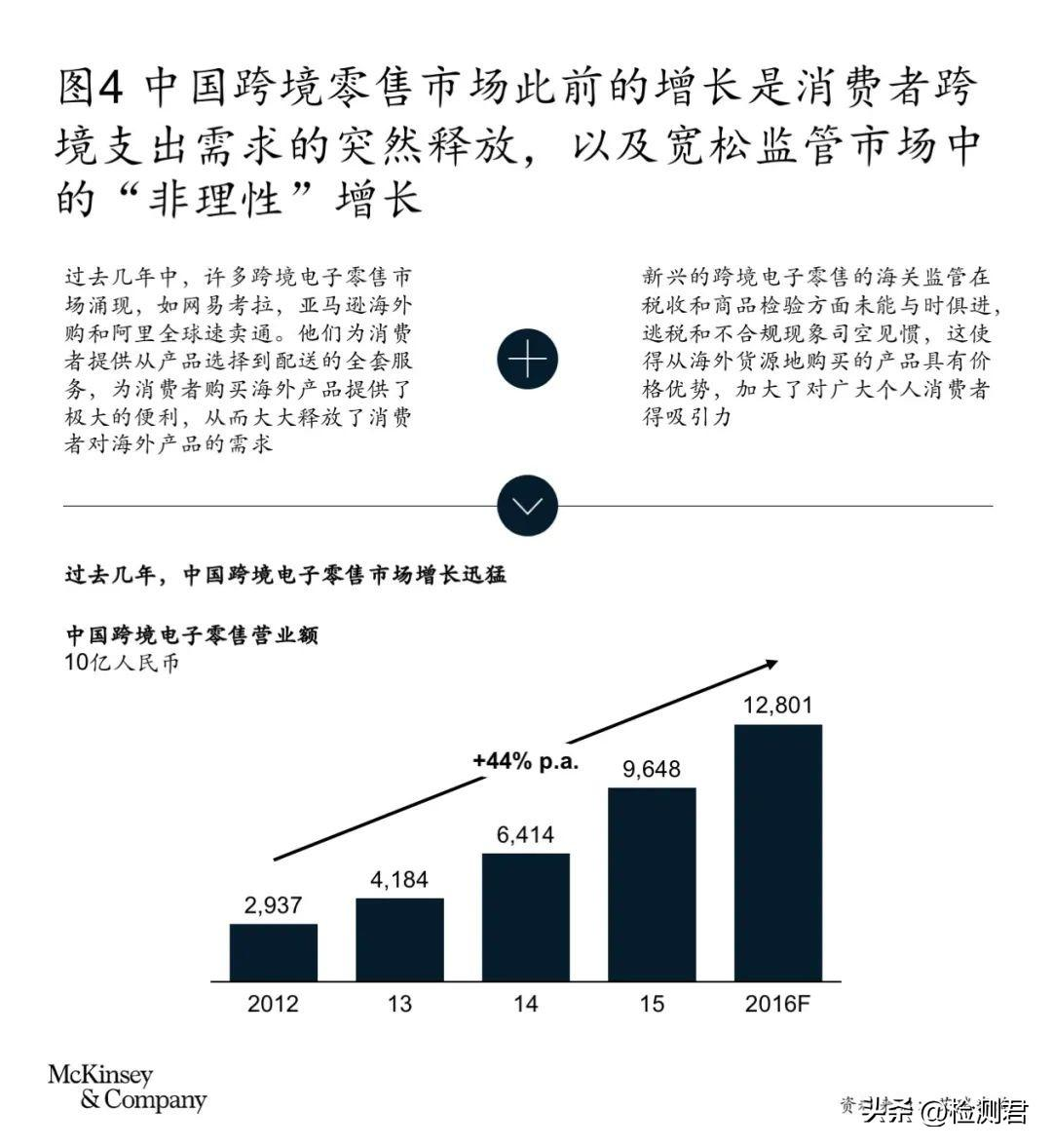

The Internet has built an economical and efficient communication “bridge” between buyers and sellers around the world. With the rise of enabling technologies such as secure payments, order tracking and customer service, the global e-commerce market has grown exponentially. Global cross-border e-commerce transactions are expected to grow from $400 billion in 2016 to $1.25 trillion in 2021. As the leader of this growth trend, from 2012 to 2016, the size of China’s cross-border e-commerce market increased from RMB 293.7 billion to RMB 1,280.1 billion. This is mainly due to two points: 1) the sudden release of cross-border consumer demand; 2) the relatively loose market supervision environment. The development of online websites, social media and logistics technology has also played a key role in promoting the development of cross-border e-commerce. Subsequently, the Chinese government further encouraged the development of cross-border e-commerce by creating free trade zones and promoting the “Belt and Road” initiative. Enterprises such as Cross-border, Amazon and Tmall have made full use of relevant policies and gradually gained a firm foothold in the free trade zone. The strategically dominant express delivery companies and third-party logistics companies in the region are also gearing up to take advantage of the growing trade activity along the Belt and Road markets. However, with the introduction of a series of regulatory policies by the government and the technical control of channel retail prices, the previous exponential growth of China’s cross-border retail will become more rational. In addition, the industry itself does face many challenges, such as worrying about the quality of cross-border products, inefficient customs clearance processes, and imperfect cross-border dispute resolution mechanisms. Led by China, cross-border trade will inject new impetus into the future of e-commerce. With the gradual blurring of geographical boundaries, truly valuable companies will be able to cross borders and accept the brutal test of real guns in the global market. Enterprises that sell out will be able to rewrite the rules of the game by taking advantage of their advantages; while organizations that return bitterly need to restructure their strategies and wait for the opportunity.

Overview

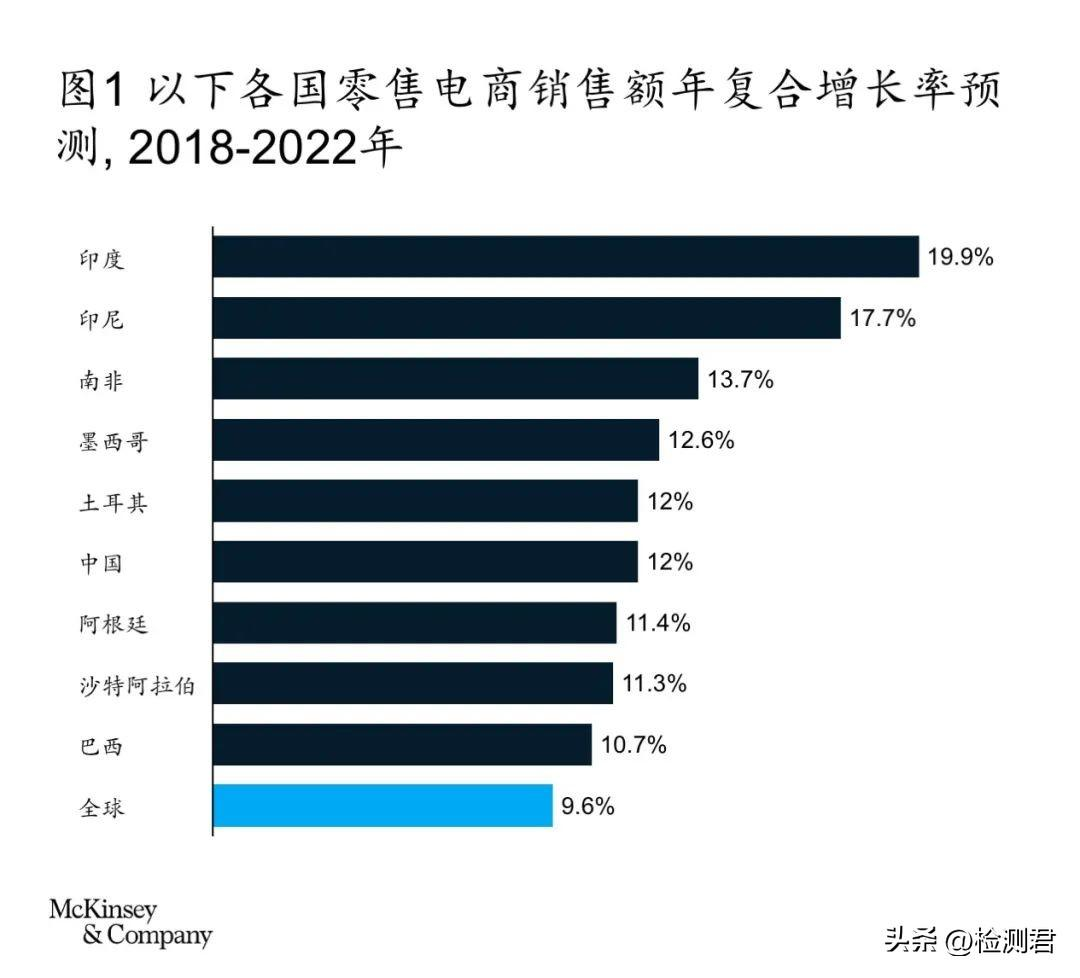

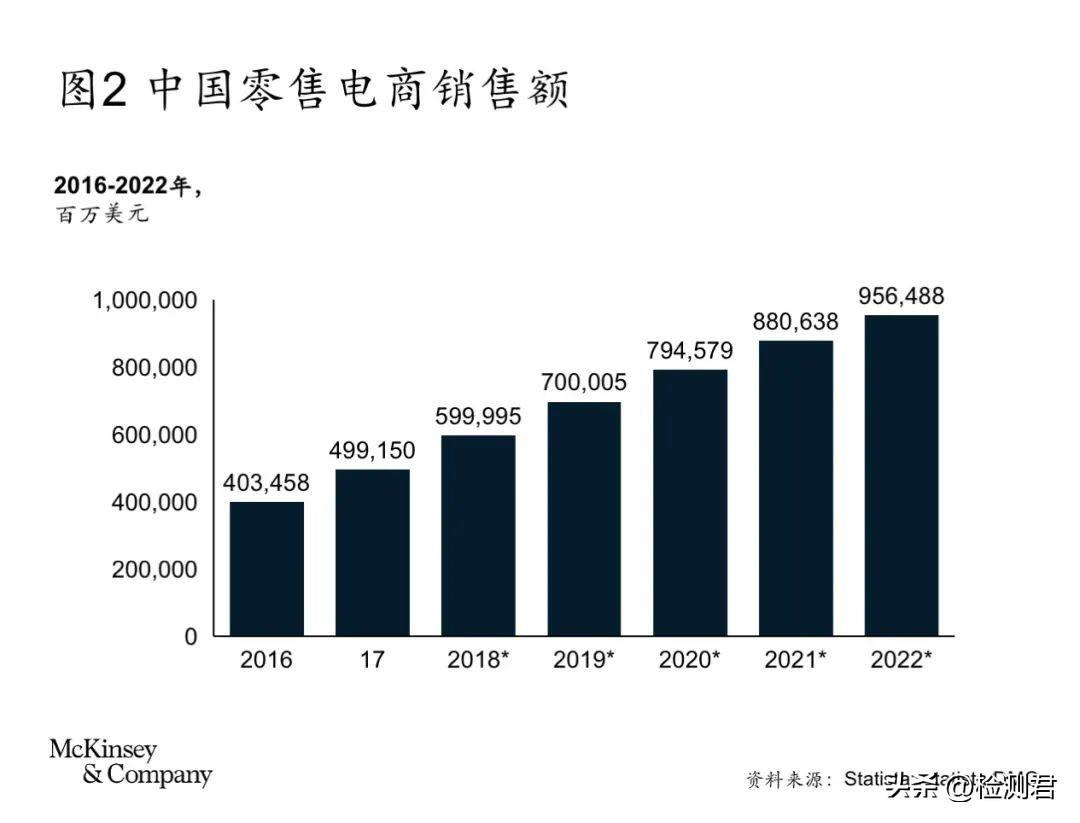

The Internet has built an economical and efficient communication “bridge” between buyers and sellers around the world. The global e-commerce market has grown exponentially with advances in enabling technologies such as secure payments, order tracking, and customer service. From 2014 to 2017, global e-commerce retail sales (products or services, excluding travel and event tickets, etc.) grew from $1.336 trillion to $2.304 trillion, and this figure is expected to reach $4.878 trillion in 2021. Over the same time period, e-commerce’s share of total global retail sales has grown from 7.4% to 10.2%, and is expected to reach 17.5% by 2021. From 2017 to 2022, China’s total e-commerce retail sales are expected to grow from US$499.015 billion to more than US$956.488 billion. In 2015, e-commerce accounted for only 15.9% of total retail sales in China, but this share is expected to reach 33.6% in 2019. According to this calculation, China’s e-commerce growth rate is already higher than the global average. Global cross-border e-commerce transaction volume is expected to grow from $400 billion in 2016 to $1.25 trillion in 2021, a 26% year-on-year increase. The main driving factors behind it are the high popularity of smartphones and the Internet, the fierce competition of various products, and the further enhancement of consumer awareness. Looking back on the development of the past few decades, factors such as the lack of local products, the gradual disappearance of physical stores, the continuous decline of costs, and the improvement of logistics in the international market have all subtly increased the importance of cross-border e-commerce.

China’s e-commerce market

The growth of e-commerce in China

E-commerce in China has grown rapidly in the past few years – in 2016, the size of the Chinese e-commerce market was approximately US$403.458 billion, this figure increased to 499.15 billion in 2017, and is expected to exceed 956 billion in 2022. This growth can be attributed to a variety of factors, such as rising smartphone penetration, poor shopping experience in brick-and-mortar stores, and intense competition in the e-commerce market.

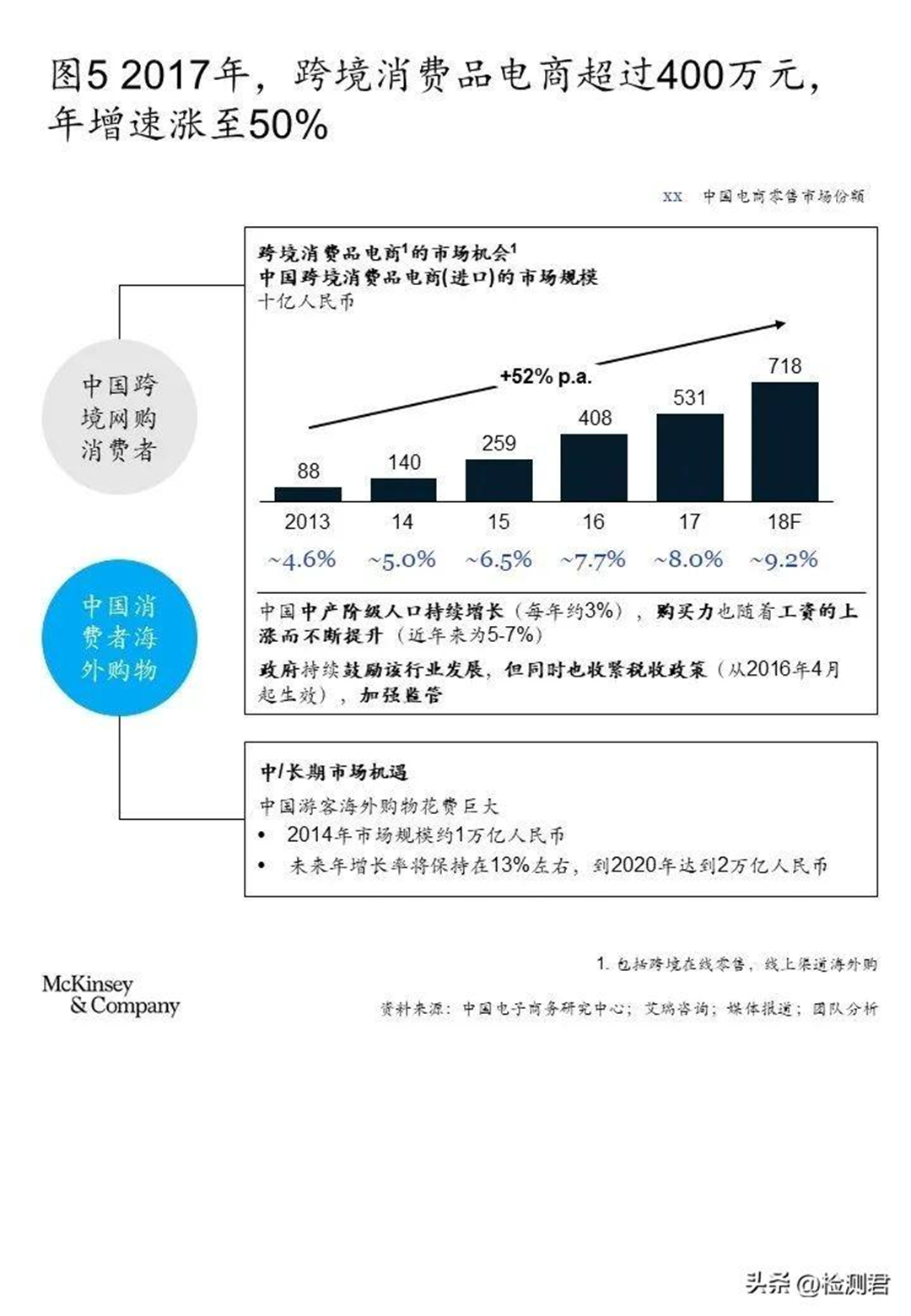

What’s driving growth The middle-income class is the main force in cross-border shopping. They have strong purchasing power and higher pursuit of quality of life (including pursuit of quality products/well-known brands). This means that they are willing to buy products from overseas through cross-border online retail channels as long as the price is satisfactory (as long as the overseas retail price of the product plus shipping costs and tariffs is lower than the retail price in China). In the next five years, the size of China’s middle-income group will continue to expand (annual growth rate of about 3%), and the income level will further increase (an average annual growth rate of 5% to 7%), which will further enhance the purchasing power of this group. Strong purchasing power and demand for quality products will further drive the growth of the cross-border online retail market. In addition, the Chinese government is also greatly supporting the development of cross-border online retail for the purpose of transferring overseas consumption back to China. China has established several major free trade zones in the country, dedicated to promoting the development of cross-border e-commerce industries (such as bonded warehouses). Technology also plays a key role in facilitating the development of cross-border e-commerce: Today, consumers can easily browse products from around the world without leaving their homes with just a tap of the screen of their mobile phone. Retailers no longer exist only in brick-and-mortar stores, but are increasingly moving to online websites, social media and mobile apps to provide consumers with a variety of sales channels. In addition to bringing omni-channel retailing, emerging technologies have also significantly improved logistics service capabilities. After the seamless integration of online sales channels and logistics networks, logistics information will become more transparent, making it easier for consumers to query and track orders anytime, anywhere. The convenience of online shopping will continue to drive the growth of cross-border e-commerce.

Cross-border e-commerce in China

China’s cross-border online retail market has grown rapidly over the past few years: Between 2012 and 2016, China’s cross-border online retail transaction volume surged from RMB 293.7 billion to RMB 1,280.1 billion, an average annual growth of44%.

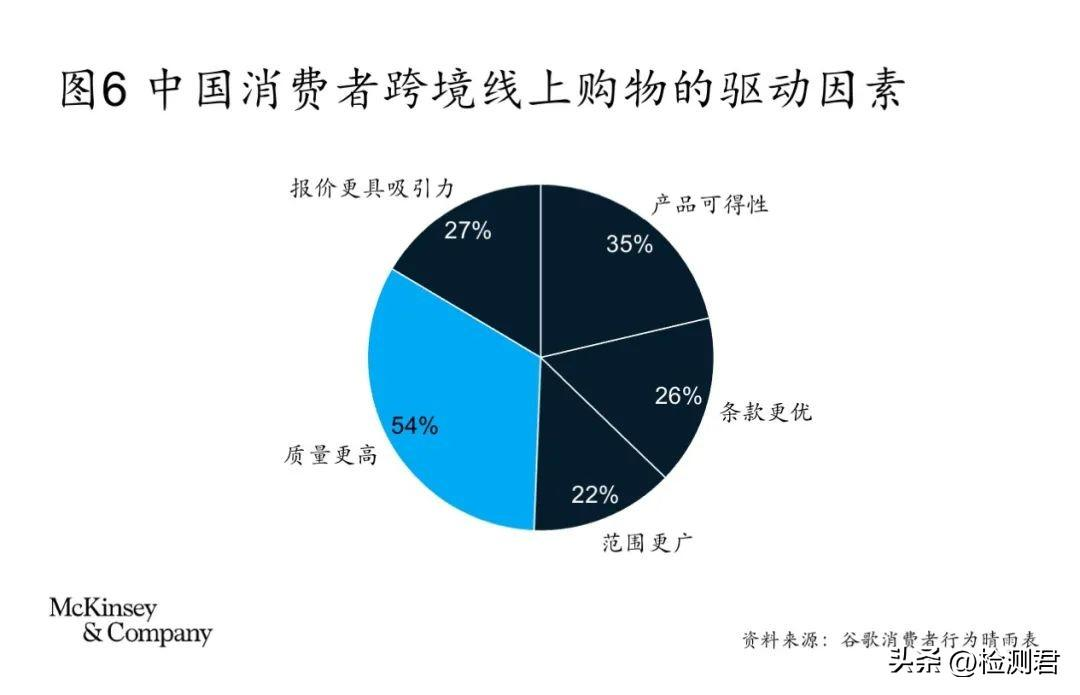

1 Import and export structure

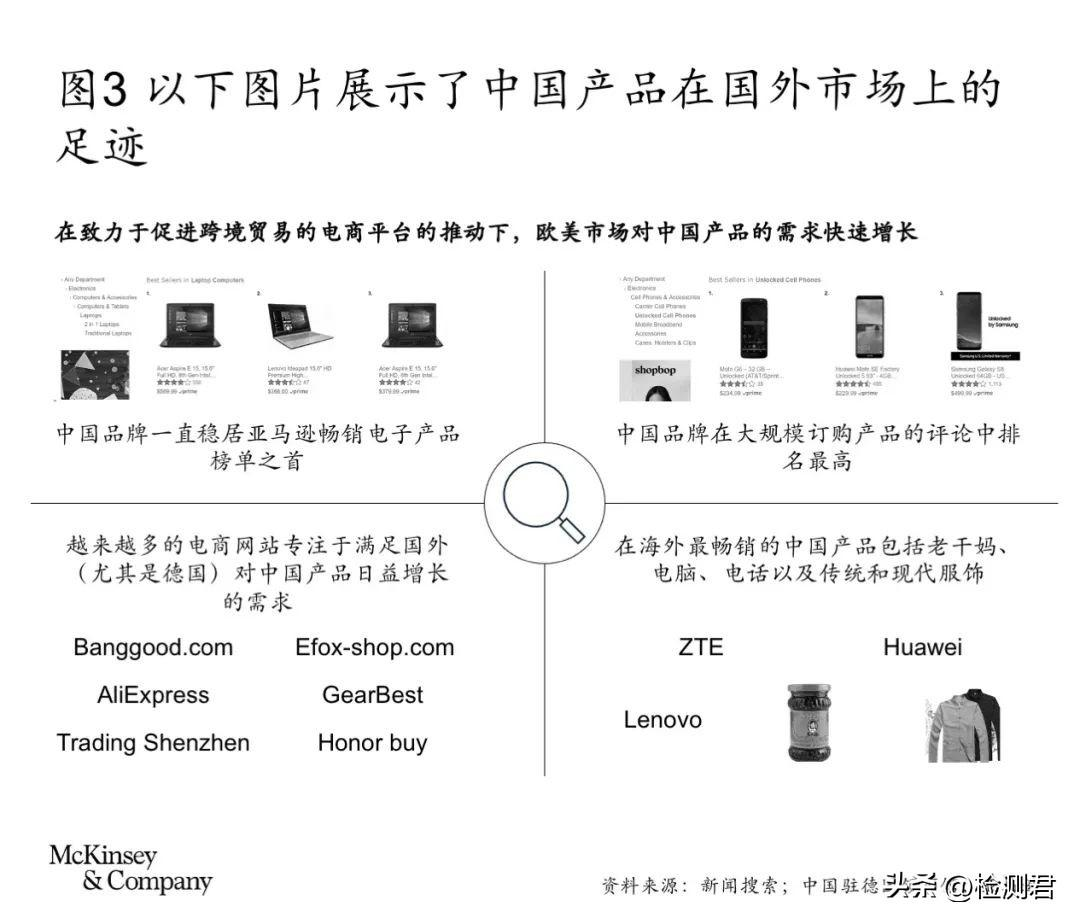

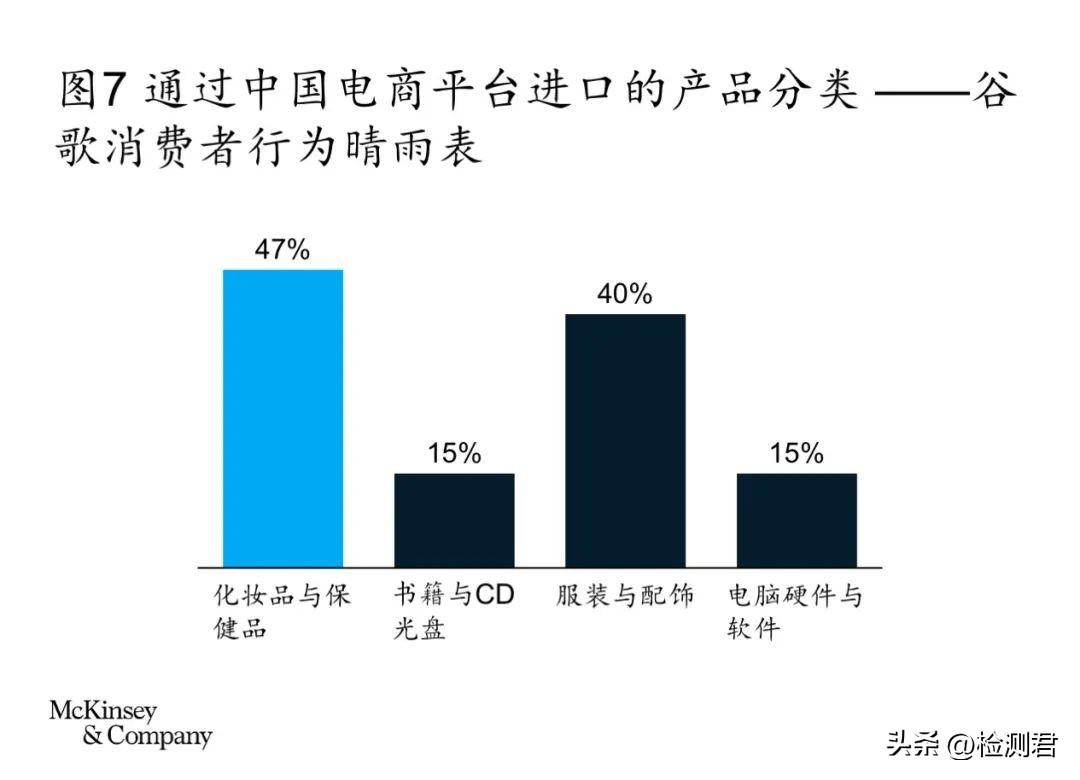

The product categories that Chinese consumers purchase from international markets (such as the United States, Japan, Germany, South Korea, Australia, the Netherlands, France, the United Kingdom, Italy, New Zealand, etc.) through e-commerce platforms mainly include cosmetics and health products, books and CDs, Apparel and accessories, and computer hardware and software. At the same time, China is also exporting mobile phones and accessories, fashion, health and beauty, consumer electronics, and sports and outdoor products to the United States, the United Kingdom, Hong Kong, Brazil, Germany, France, Russia, Japan and South Korea. Among them, the increase of product variety, the optimization of terms, the increase of regional coverage, the improvement of quality, and the more attractive prices are the main factors driving the development of the above-mentioned cross-border shopping.

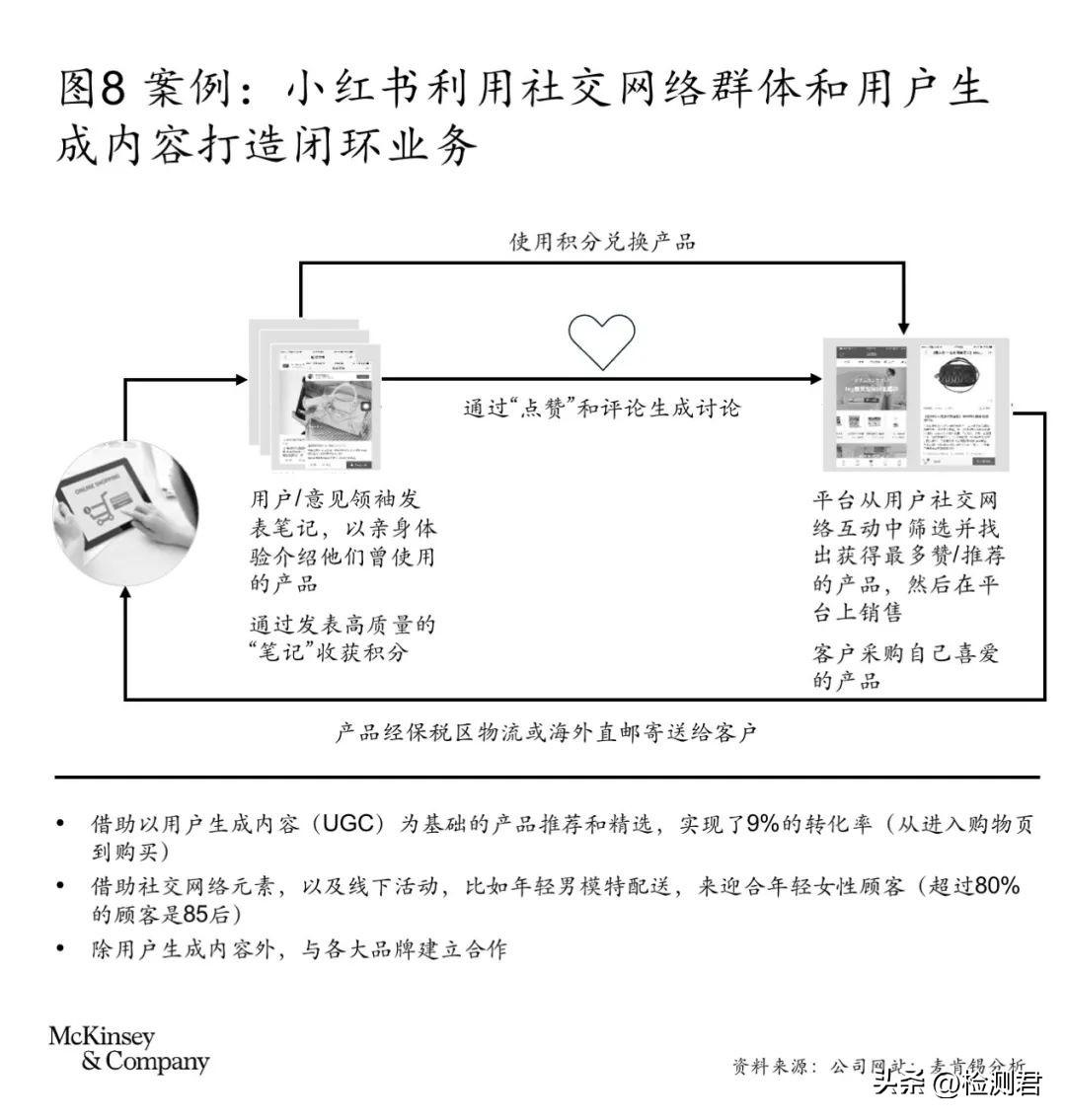

2 Case analysis

Channel retail price control: The advent of new technologies has brought more transparent pricing to consumers, retailers and e-commerce platforms. Considering that consumers can easily shop overseas with the help of cross-border e-commerce, some retail brands are gradually realizing that the price gap between different regions of the world and online and offline may lead to the phenomenon of unbalanced revenue between different regions and affect the market. profit. This is particularly evident in the lucrative luxury goods industry. Therefore, many big brands have begun to adjust prices to narrow the price difference between regions, which reduces the attractiveness of cross-border shopping to a certain extent.

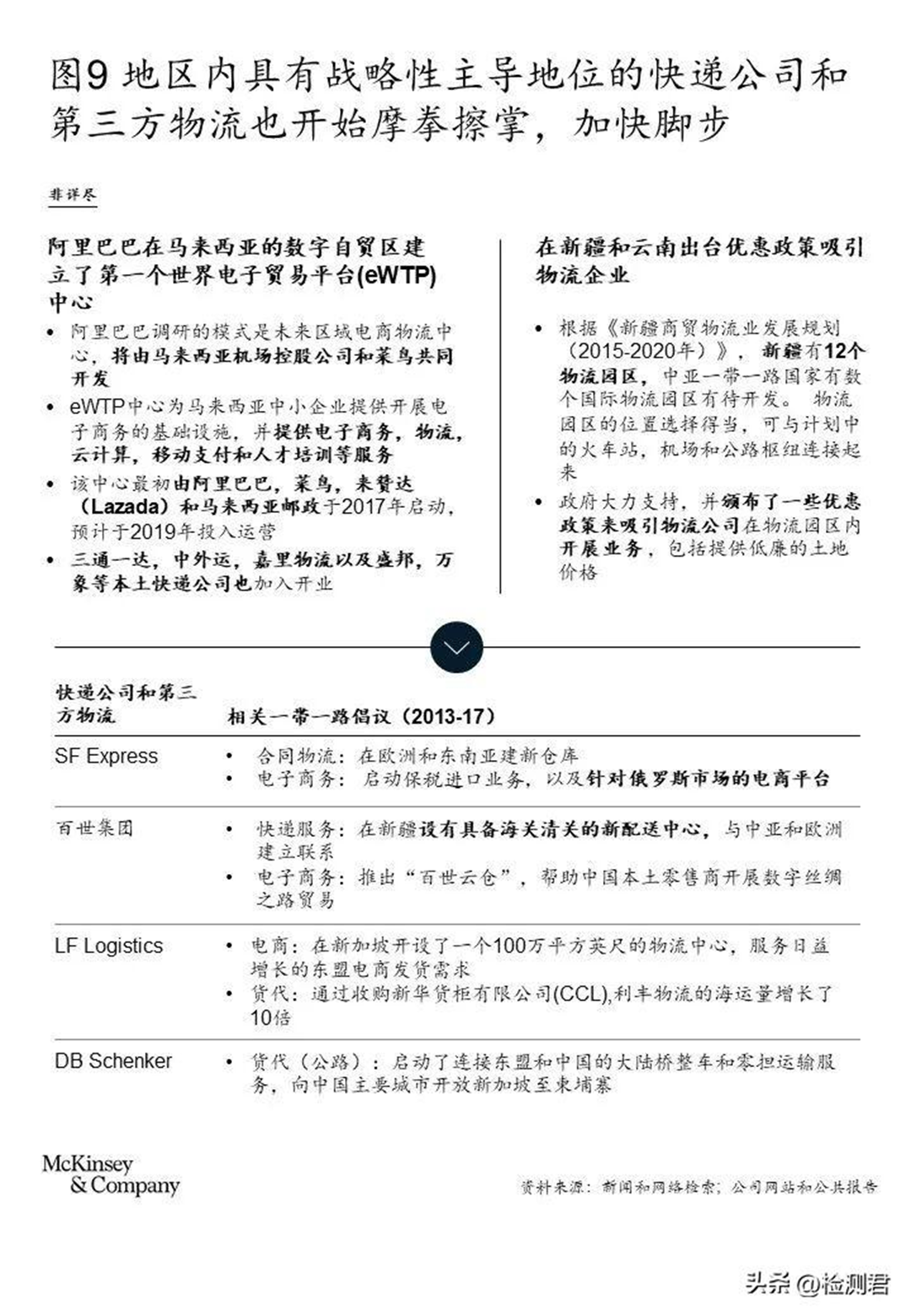

The strategically dominant express delivery companies and third-party logistics companies in the region are also gearing up to speed up their efforts to benefit from the growing trade activity along the Belt and Road markets. SF Express has launched the bonded import business and built an e-commerce platform for the Russian market; Best Huitong has established a cross-border e-commerce customs clearance and distribution center in Xinjiang to connect the Central Asian and European markets. “Cloud Warehouse” can help local Chinese retailers carry out digital Silk Road trade; Li & Fung Logistics has built a 1 million square foot logistics center in Singapore to meet the growing demand for ASEAN e-commerce shipments.

The growth of e-commerce in China

Looking ahead, consumers’ demand for cost-effective overseas products will further drive the development of the cross-border online retail market. However, as regulators further increase their attention, the price advantage previously enjoyed by cross-border retail products will be weakened, and the development of the market will gradually slow down. In McKinsey’s view, with the introduction of a series of regulatory policies by the government and the technical control of channel retail prices, the previous exponential growth of cross-border retail in China will become more rational. In addition, the government has taken some favorable measures to help cross-border e-commerce develop in a healthy and sustainable direction.

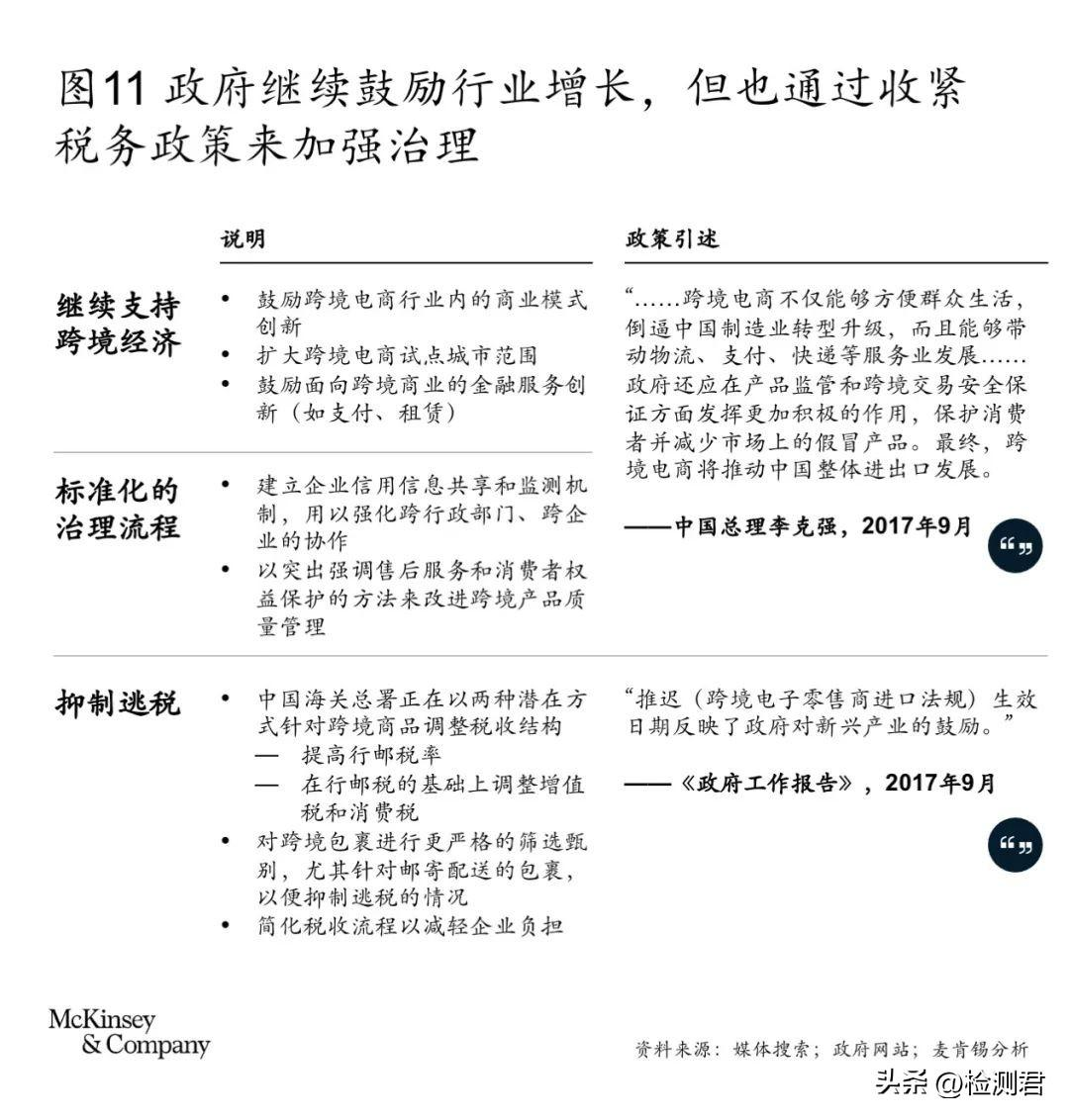

1 Government initiatives

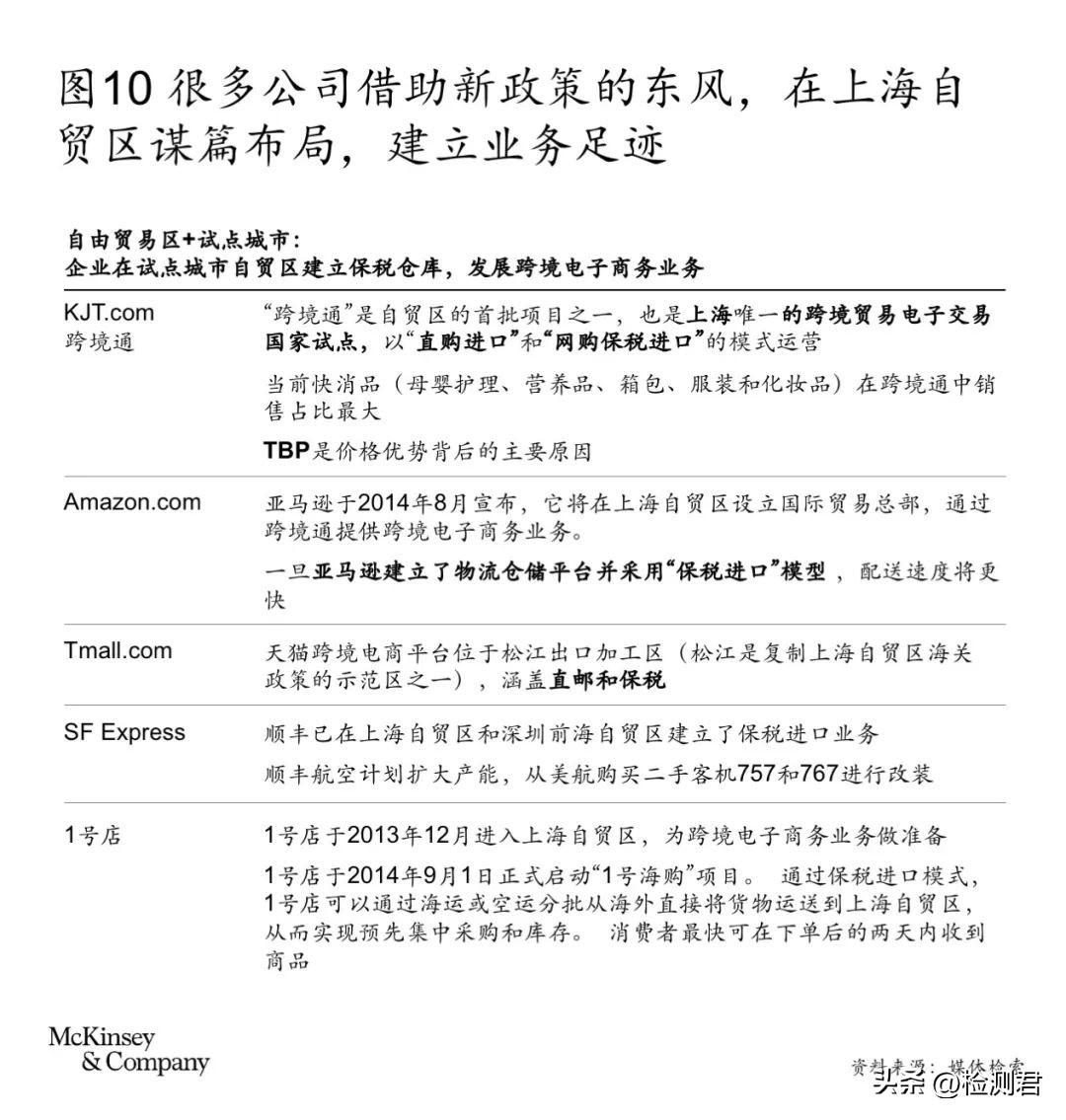

New tax policy:The government has been continuously improving the tax policy for cross-border e-commerce in order to regulate the industry order and achieve a healthier and more balanced development. On the one hand, the implementation of the new tax policy will bring about an increase in the postal tax, thereby cracking down on personal purchasing; on the other hand, after the implementation of the new tax rate, the tax burden of cross-border e-commerce will be reduced, which will bring benefits to e-commerce platforms. In addition to changes in tax policies, the government has also set up pilot cities for cross-border e-commerce platforms/parks to attract various cross-border e-commerce companies and encourage industry development. The new tax policy will help strengthen government governance, curb tax evasion, and increase cross-border tax revenue. It can also expand the category of imported goods by adjusting the tax structure, such as imposing higher tax rates on high-value products, encouraging the import of long-tail products, not just best-selling goods. The reduction in postage tax will also make consumers turn more to direct mail for low-end/low-cost products. In order to ensure the smooth transition and effective implementation of the new tax policy, the Chinese government has postponed the implementation of the new tax policy to the end of 2018 out of strategic considerations. Promoting the construction of free trade zones: China has been promoting the construction of free trade zones since Shanghai established its first free trade zone in 2013. After 2015, various places began to copy this model, thus extending the free trade zone to the whole country. Up to now, there are 18 free trade zones in mainland China. The establishment of free trade zones/warehouses and the expansion of e-commerce pilot cities have further encouraged e-commerce companies to conduct cross-border business. In addition, the preferential policies in the free trade zone are also conducive to improving the efficiency of cross-border e-commerce logistics and regional economic integration. Logistics service providers headed by SF Express are also eager to jump on the “cross-border e-commerce” express train, and they have begun to operate in the free trade zone to seize the fast-growing cross-border market opportunities by providing comprehensive import and export logistics services. . “One Belt One Road”: The “One Belt One Road” initiative aims to revive the ancient Silk Road into a modern transit transportation, trade and economic corridor, facilitate cross-border trade, and create ” the opportunity to go out”. For example, Alibaba has built the first World Electronic Trade Platform (eWTP) center in Malaysia’s digital free trade zone. The center, which was put into operation in 2019, aims to play the role of a regional e-commerce logistics hub and create a more convenient business environment for small and medium-sized enterprises conducting global trade.

2 Challenges

Cross-border e-commerce consists of 5 stages: commodity declaration, warehousing and logistics, customs approval, transaction settlement and after-sales service. The problems encountered by Chinese cross-border e-commerce companies include: delays in customs clearance, complex tax refund structure, high cost of international logistics, and poor after-sales service. These problems can be attributed to the following reasons: the quality of cross-border e-commerce products is worrying, considering that it is too cumbersome to unpack and test products one by one, and currently only basic product inspections can be carried out, which makes it inevitable to doubt the product quality. In addition, key standards for domestic and international products are still ambiguous, and “friction” is inevitable in the process of customs approval and quarantine. Traditional customs clearance models are inefficient These traditional models are common in B2B trade and bulk commodity declarations. However, B2C transaction orders of cross-border e-commerce are usually small and scattered, and such traditional models will prolong the time of customs quarantine. The regulation of e-commerce platforms lags behind China’s small and medium-sized enterprises trade through e-commerce platforms. Such platforms are classified as import and export entities by the Chinese government. Once a company’s products have quality problems or involve cross-border tax evasion, the platform will be punished, not the corresponding company. Inefficiency in cross-border dispute resolution The United Nations International Trade Commission (United Nations International Trade Commission) proposed a series of procedures for resolving cross-border e-commerce disputes in 2009. The above-mentioned dispute settlement mechanism has not been adopted due to the inconsistent claims of various countries. Therefore, the efficiency of after-sales service and dispute resolution of cross-border e-commerce is very low.

Diversification through cross-border e-commerce The new crown epidemic is spreading rapidly, affecting almost all countries in the world. During the epidemic, due to the vastly different development stages of various countries, the performance of consumer behaviors related to independent cross-border e-commerce imports in major markets is also different. Considering that the number of cases in most countries peaked one by one before May 2020, many brands and retail companies that sell across markets are also balancing sales between different markets as appropriate; many countries even witnessed during the epidemic. Increased international e-commerce sales.

A key tool for optimizing cross-border e-commerce Merchants must simplify the shopping journey and provide a seamless shopping experience tailored to the shopping preferences of each market in order to reap the profitable returns that cross-border e-commerce can bring. As more and more consumers join online shopping, merchants will also need to adjust the shopping interface to provide a localized shopping experience similar to the country where consumers are located. These features include: viewing prices and payments in your local currency, accepting locally exclusive and other payment methods, automating tax calculations and supporting prepayment, offering affordable shipping and returns, and more.

Specific issues to address during the pandemic:

Update the relevant information of the target market. E-commerce platforms should communicate clearly with consumers around the world, and clearly communicate whether online shopping is actually open to them. In addition, platforms must also provide consumers with a streamlined, localized customer experience. Launching Promotions and Discounts Promotions and discounts have always been an effective way for merchants to convert traffic into sales and increase customer conversion rates. Adopting a multi-carrier model in international logistics Cross-border travel has been hindered by border closures and home isolation, and international cargo flights have also been greatly reduced, resulting in delays in delivery in some markets. The multi-carrier model allows freight companies to use their own fleets, which means that merchants can avoid delayed deliveries as much as possible, reduce the impact of the epidemic on cross-border e-commerce logistics, and improve the quality of customer service. Communicate candidly with global consumers For e-commerce platforms, in order to meet customer expectations as much as possible and provide high-quality services, they must be candid with global consumers, clearly inform that there may be delays in delivery of goods, and provide real-time order information. track. This is especially important during the pandemic. In addition, platforms must provide easy return options and adjust return policies to allow sufficient time for consumers to return.

The closure of borders and social isolation has prompted more consumers to choose online shopping, and e-commerce channels have naturally become consumers’ first choice. Even though brick-and-mortar malls in some markets have resumed business, consumers’ enthusiasm for online shopping has not diminished. McKinsey believes that the process of online shopping will only accelerate, and the new crown epidemic will not stop its explosive growth from the previous decade. The outbreak has accelerated the transformation of global online brands to a D2C model (direct-to-consumer). This will not only help brands effectively deal with the subsequent drop in physical store traffic, but also preserve the brand’s identity and value during the transition to e-commerce retail. The difference in performance among the major markets highlights the importance of diversification, which also points the way for the future of e-commerce platforms. Relying on e-commerce platforms, merchants can not only expand the global market, but also diversify risks. As the two fastest-growing economies of the century, China’s e-commerce sector is booming. Led by China, cross-border trade will inject new impetus into the future of e-commerce and have a major impact on the development of the industry itself and the country as a whole. With the gradual relaxation of the current restrictive measures, the domestic e-commerce market will change dramatically. Really valuable companies will be able to cross borders and accept the brutal test of real guns in the global market. Therefore, both national governments and business organizations should strive to improve their competitiveness in order to win in the market competition.

Post time: Oct-17-2022